Tokyo Travel Insurance: What to Cover & Recommended Providers

Tokyo Travel Insurance – Tokyo travel insurance becomes critical when facing Japan’s upfront medical payment system, where emergency room visits cost $500-$1,500 and serious accidents can reach $51,000.

Essential coverage includes all-encompassing medical protection, natural disaster coverage for earthquakes and typhoons, trip cancellation benefits, and emergency evacuation services that can cost up to $100,000.

Tokio Marine offers excellent interpretation services and direct hospital payments, while international providers like Allianz provide robust earthquake coverage.

Smart travelers discover additional strategies for maximizing protection while minimizing costs.

Key Takeaways

Hide- Medical emergency coverage is essential as Tokyo hospitals require upfront payment and costs can exceed $51,000 for accidents.

- Natural disaster protection including earthquake, tsunami, and typhoon coverage fills critical gaps that standard policies typically exclude.

- Trip cancellation insurance protects against weather disruptions and natural disasters common during Tokyo's typhoon season.

- Tokio Marine offers comprehensive plans with real-time interpretation services and direct payment options to healthcare providers.

- Emergency medical evacuation coverage is crucial as single flights home can cost $50,000-$100,000 from Tokyo.

Why Tokyo Travel Insurance Matters More Than You Think

Most travelers assume their home country insurance will cover them abroad, but Japan’s medical system operates differently—a simple bicycle accident resulting in collapsed lungs and fractured ribs can easily cost $51,000 upfront, with hospitals requiring immediate payment before treatment begins.

Tokyo sits in one of the world’s most seismically active zones, where earthquakes, tsunamis, and volcanic activity from nearby Mount Fuji create emergency scenarios that standard travel policies simply don’t address.

- Tokyo Luggage Storage Guide for Travelers

- Complete Guide to Topping Up a Suica Card in Tokyo

- Navigating Tokyo’s Airports: From Narita to Haneda Smoothly

- How to Save Money on Tokyo Attractions With Discount Passes

- 10 Must-Know Tokyo Metro Shortcuts for Travelers

- Tokyo Drinking Water: Tap Water Safety & Alternatives

Without proper Tokyo-specific coverage, visitors risk not only devastating financial costs but also potential denial of care when they need it most, since Japanese hospitals routinely refuse treatment to foreign patients who can’t prove their ability to pay.

The travel insurance market reflects this growing awareness, with digital platforms and social media campaigns increasingly educating travelers about real-world scenarios where proper coverage becomes essential.

Japan’s High Medical Costs That Could Shock American and European Visitors

The sticker shock hits fast when foreign visitors discover that a simple emergency room visit in Tokyo can easily cost $500-1,500 without insurance.

Meanwhile, American and European tourists often assume their home coverage will protect them abroad.

Hospital fees escalate quickly for uninsured patients, with private facilities charging full rates that can reach astronomical levels for procedures that might seem routine back home.

Tokyo Trip Add-Ons

Equip yourself for the ultimate Tokyo adventure with the following add-ons, curated just for you.

Japan is now implementing stricter entry regulations that require proof of medical insurance before visa issuance to address the growing problem of unpaid medical bills from tourists.

Even basic prescription medications become surprisingly expensive at Japanese pharmacies, where foreign visitors face both language barriers and premium pricing.

This combination can turn a simple cold remedy into a budget-busting expense.

Emergency Room Visits and Hospital Fees Without Insurance Coverage

Imagine this nightmare scenario: a foreign visitor collapses on a bustling Tokyo street, gets rushed to a pristine Japanese hospital, receives excellent medical care, and then faces a bill that could easily cost more than their entire vacation budget.

Emergency room visits range from $140 to $350, while understanding cultural sensitivities and local hospital protocols becomes vital when hospitals demand immediate upfront payment from uninsured tourists.

Daily inpatient bed charges can escalate from $100 for shared rooms to $800 for private rooms, creating costs that accumulate rapidly during extended stays.

Prescription Medication Costs and Pharmacy Access for Foreign Tourists

Four out of five foreign visitors to Tokyo discover too late that their home country prescriptions become worthless pieces of paper the moment they step off the plane at Narita Airport.

Pharmacy language barriers complicate even simple requests, while over the counter medication options remain frustratingly limited compared to Western standards, forcing tourists into expensive consultations.

When serious medical situations arise, treatment costs can reach 7.5 million yen for trauma cases or even 10 million yen for heart attacks, making comprehensive travel insurance essential protection.

Natural Disaster Risks Unique to Tokyo That Standard Policies Miss

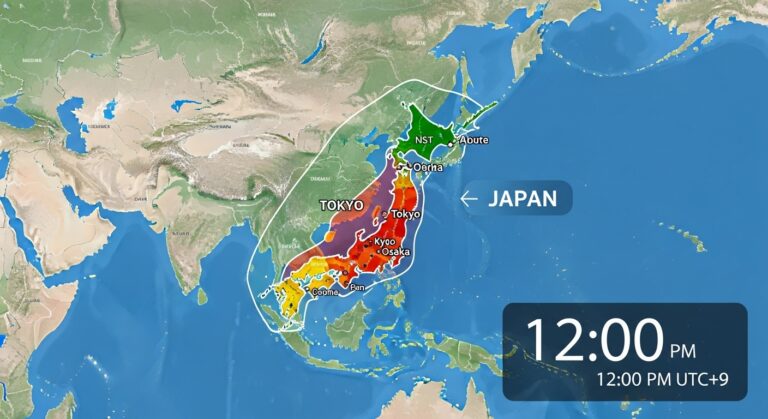

Tokyo sits on one of the world’s most geologically active zones, where massive earthquakes, devastating tsunamis, and powerful typhoons create a perfect storm of natural disaster risks that most standard travel insurance policies simply don’t address adequately.

While your basic coverage might handle a delayed flight due to weather, it probably won’t protect you when a magnitude 7 earthquake strands you as one of potentially 4.53 million displaced commuters, or when typhoon flooding traps you in underground shopping areas that become dangerous water traps.

Parts of Tokyo have sunk nearly 5 meters over the last century due to rising sea levels and groundwater pumping, making flood risks even more severe during extreme weather events.

The city’s unique vulnerabilities—from its below-sea-level districts to its volcanic ash risks—demand specialized insurance coverage that goes far beyond typical “acts of God” clauses.

Earthquake and Tsunami Coverage Gaps in Basic Travel Insurance Plans

While most travelers assume their basic travel insurance will protect them from Japan’s notorious seismic activity, the reality reveals shocking coverage gaps that could leave visitors financially devastated when the earth starts shaking.

Standard policies explicitly exclude earthquake damage, pre-emptive cancellations from seismic warnings, and tsunami insurance coverage.

Tokyo sits within the Circum-Pacific Belt, where approximately 80% of global earthquake energy originates, making specialized coverage even more critical for visitors.

Proper seismic preparedness requires specialized riders that dramatically increase costs but provide essential protection.

Typhoon Season Disruptions and Flight Cancellation Protection Needs

When September arrives and the Pacific starts churning with massive storm systems, travelers discover that Tokyo’s typhoon season transforms their carefully planned vacation into a high-stakes gamble with Mother Nature!

Haneda Airport’s coastal vulnerability to storm surge creates cascading shutdowns lasting 24-72 hours.

Standard policies won’t cover these “predictable” disruptions, making specialized flood insurance absolutely essential for protecting your freedom to explore.

The Kanto region, which includes Tokyo, experiences an average of 0.8 typhoon approaches annually, with most activity concentrated during the late summer months when travelers are most likely to visit.

Essential Coverage Types Every Tokyo Traveler Should Secure

When selecting Tokyo travel insurance, savvy travelers focus on three fundamental coverage areas that transform potential disasters into manageable inconveniences.

Medical emergency protection becomes absolutely critical since Japanese hospitals operate differently from Western facilities and won’t accept your home country’s health insurance.

With ICU stays exceeding ¥100,000 daily and private rooms costing over ¥30,000 per night, adequate medical coverage prevents devastating financial exposure.

All-encompassing trip cancellation coverage shields your investment from Tokyo’s unpredictable typhoon season and family emergencies back home.

Smart travelers also prioritize robust baggage protection, because losing your luggage in a city where finding replacement clothes in Western sizes can prove challenging turns a minor setback into a major headache!

Medical Emergency Coverage That Actually Works in Japanese Hospitals

When a medical emergency strikes in Tokyo, two critical services can make the difference between a manageable situation and a nightmare scenario: English-speaking medical staff and reliable ambulance transportation.

Most Tokyo hospitals offer 24/7 interpretation services through all-encompassing travel insurance policies, eliminating the terrifying prospect of explaining chest pain or allergic reactions through hand gestures and broken Japanese!

Emergency medical evacuation coverage becomes absolutely essential in Japan’s dense urban environment, where ambulance costs and potential helicopter transfers to specialized facilities can quickly escalate into five-figure expenses that would devastate any vacation budget.

Quality travel insurance should provide 24/7 customer support to assist with emergency coordination and claims processing when medical situations arise in Tokyo’s complex healthcare system.

English-Speaking Medical Services and Translation Assistance Benefits

How frustrating would it be to suffer a medical emergency in Tokyo only to discover that your insurance coverage becomes virtually useless because nobody can understand what’s wrong with you?

Language barriers and cultural differences vanish when providers like Tokio Marine offer real-time interpretation services, connecting travelers with English-speaking medical professionals instantly through mobile apps.

The policy enables direct payment to healthcare providers, eliminating the stress of upfront costs during medical emergencies when most Japanese hospitals don’t accept credit cards.

Ambulance Transportation Costs and Emergency Medical Evacuation Options

The staggering reality of medical evacuation costs in Tokyo will make even the most budget-conscious traveler rethink their insurance strategy—a single emergency flight home can easily cost $50,000 to $100,000.

Some cases have been documented at over seven million yen for exhaustive care and repatriation. Ambulance billing and medical transportation expenses demand all-encompassing coverage.

Japanese hospitals maintain high-quality standards but require substantial financial resources without proper insurance protection.

Trip Cancellation and Interruption Protection for Tokyo Vacations

Tokyo’s legendary cherry blossom season transforms the city into a pink paradise, but booking accommodations during this peak period comes with sky-high cancellation penalties that can devastate your wallet if plans change unexpectedly.

The lingering specter of COVID-19 continues to create travel chaos through sudden quarantine requirements, border closures, and health-related trip disruptions that standard airline policies simply won’t cover.

Smart Tokyo travelers now recognize that all-inclusive trip cancellation and interruption protection isn’t just insurance—it’s financial armor against the unpredictable forces that can derail even the most meticulously planned Japanese adventure.

This coverage typically costs about 6%-7% of your total trip price, making it a relatively small investment for substantial financial protection.

Cherry Blossom Season Booking Challenges and Cancellation Penalties

When cherry blossom fever strikes Tokyo, even the most seasoned travelers find themselves caught in a whirlwind of booking chaos that can turn dream vacations into financial nightmares!

Hotels impose brutal 50-100% cancellation penalties within 30 days, while accommodation prices skyrocket 30-50% during peak bloom weeks.

With 6-12 months early booking recommended to secure preferred accommodations, travelers face extended exposure to potential cancellation risks.

Smart suitcase organization and airport navigation skills won’t save you from these crushing financial penalties!

COVID-19 Related Trip Changes and Quarantine Expense Coverage

Pandemic-era travel to Tokyo demands a completely different insurance strategy than traditional vacation planning, with COVID-19 coverage now serving as the backbone of any sensible travel protection plan!

Smart travelers prioritize COVID Quarantine coverage alongside all-encompassing medical benefits. Quality policies offer direct hospital payments and Expense Reimbursement for mandatory isolation costs, including accommodation and meals.

Medical evacuation services ensure travelers can access suitable hospitals or transfer between facilities when emergency transport becomes necessary during health crises.

Baggage and Personal Property Protection During Tokyo Travel

Tokyo’s bustling streets and crowded transit hubs present unique challenges for protecting your valuable electronics and luggage, making thorough baggage coverage absolutely essential for any traveler carrying expensive camera gear or tech devices.

The city’s premium shopping districts like Ginza and Shibuza mean replacement costs for lost items can easily exceed typical coverage limits, particularly when you’re scrambling to replace specialized photography equipment or essential electronics mid-trip.

Smart travelers recognize that Tokyo’s complex transportation network, from Narita’s international terminals to the labyrinthine subway system, greatly increases the likelihood of baggage mishaps that could derail an otherwise perfect vacation.

Quality travel insurance plans provide compensation for delayed, lost, or stolen belongings, including necessary personal items you’ll need while navigating Tokyo’s fast-paced environment.

Electronics Theft Coverage for Camera Equipment and Tech Devices

Why should travelers risk losing thousands of dollars worth of camera gear and electronics during their Tokyo adventure?

Smart explorers secure electronics theft coverage protecting cameras, laptops, and smartphones with $500-$1,000 limits per device.

While battery theft rarely occurs in Japan’s safe streets, device data protection remains excluded—only physical replacement gets covered, requiring police reports and receipts.

Additional benefits may include coverage for natural disasters, which can unexpectedly impact travel plans and equipment safety in Japan.

Lost Luggage Replacement Costs in Tokyo’s Expensive Shopping Districts

Beyond safeguarding expensive gadgets, travelers must confront an equally costly reality when airlines misplace luggage in one of the world’s most expensive shopping destinations.

Standard airline compensation caps at $1,700, woefully inadequate for replacing essentials in Ginza’s premium boutiques!

Smart luggage security planning and all-encompassing souvenir protection become essential when basic clothing costs triple normal expectations.

Travelers must report missing baggage within 21 days to ensure proper documentation and maintain eligibility for both airline compensation and insurance claims.

Top International Travel Insurance Providers for Tokyo Trips

When it comes to protecting your Tokyo adventure, three standout providers offer exceptional coverage tailored specifically for Japan’s unique travel landscape.

World Nomads leads the pack for digital nomads and adventure seekers, delivering specialized benefits that cover everything from day trips to nearby ski slopes to extended stays in bustling Shibuya!

Meanwhile, Allianz Travel brings rock-solid reliability with extensive Japanese hospital networks.

IMG Global caters to health-conscious travelers who demand premium medical protection in one of the world’s most expensive healthcare markets.

Their plans feature impressive medical limits reaching up to $500,000, providing substantial financial protection against Tokyo’s high healthcare costs.

World Nomads: Digital Nomad Favorite with Japan-Specific Benefits

World Nomads stands out as the go-to choice for digital nomads exploring Tokyo, offering flexible annual plans that cover over 250 adventure activities while providing essential Japan-specific protections like natural disaster coverage and medical repatriation.

The company’s coverage limits range from $2,000 baggage protection in their Standard Plan to $10,000 in the Explorer tier, with premium costs varying markedly based on trip duration and the level of adventure activity coverage you select.

Travelers can purchase or extend coverage while already in Japan, providing additional flexibility for those who decide to extend their Tokyo stay.

Their 24/7 online claims system proves invaluable during Tokyo emergencies, allowing travelers to submit documentation and receive immediate assistance whether they’re dealing with earthquake disruptions in Shibuya or medical emergencies requiring Japan’s notoriously expensive healthcare services.

Coverage Limits and Premium Costs for Different Trip Durations

Understanding the financial landscape of Tokyo travel insurance requires examining how coverage limits and premium costs fluctuate dramatically based on trip duration.

Savvy travelers discovering that medium-length stays of 8-14 days offer the sweet spot for cost efficiency.

Smart adventurers avoid policy exclusions while securing premium discounts through strategic timing and coverage selection for maximum freedom.

Most travelers can expect to budget approximately 5-7% of their total trip price for comprehensive coverage when visiting Tokyo.

Claims Process Experience and Customer Service for Tokyo Emergencies

Since steering a medical emergency in Tokyo’s bustling metropolis can feel overwhelming even for seasoned travelers, World Nomads has engineered their claims process to function like a digital lifeline that works seamlessly across Japan’s tech-savvy landscape.

Their 24/7 support team understands cultural nuances and local language barriers, transforming stressful situations into manageable experiences through immediate online documentation uploads.

World Nomads provides comprehensive coverage for adventure activities like snowboarding in nearby mountain resorts and cycling through Tokyo’s extensive urban network.

Allianz Travel: Comprehensive Plans with Strong Japanese Hospital Networks

Allianz Travel stands out among Tokyo insurance providers through its robust partnerships with Japanese medical facilities, creating seamless pathways to quality healthcare when emergencies strike in the bustling metropolis.

These strategic hospital network connections mean you’ll skip the confusion of steering through Japan’s complex medical system during stressful situations.

While comprehensive travel delay coverage protects your wallet when Tokyo’s notorious transportation strikes or sudden weather events disrupt your carefully planned itinerary, the combination of medical access and delay protection makes Allianz particularly valuable for Tokyo travelers who want both health security and financial protection against the city’s unpredictable transit challenges.

The provider’s 24/7 global assistance ensures travelers receive immediate support regardless of time zones or location within Tokyo’s sprawling urban landscape.

Medical Provider Partnerships That Streamline Tokyo Healthcare Access

When medical emergencies strike during Tokyo adventures, travelers need more than just insurance coverage—they need seamless access to Japan’s world-class healthcare system without the bureaucratic maze that often accompanies international medical care.

Allianz’s strategic partnerships with Japanese hospitals eliminate cultural nuances and local regulations hurdles, offering direct billing arrangements and 24/7 coordination that transforms potentially overwhelming medical situations into manageable experiences.

While Japan ended its COVID-19 travel insurance requirement in spring 2022, maintaining comprehensive coverage remains essential for protecting against unexpected medical costs that domestic health insurance may not fully cover abroad.

Travel Delay Coverage During Japan’s Transportation Strikes and Weather

Beyond securing medical care partnerships, savvy Tokyo travelers face another reality check: Japan’s ultra-efficient transportation system, while impressively reliable, isn’t immune to Mother Nature’s tantrums or the occasional labor dispute.

Local train delays from typhoons or strikes demand robust weather event coverage—smart insurance activates after 6-12 hours, reimbursing $100-250 daily for unexpected accommodations and meals.

Japan’s susceptibility to natural disasters like earthquakes and typhoons can significantly disrupt even the most carefully planned itineraries.

IMG Global: Premium Medical Coverage for Health-Conscious Travelers

IMG Global stands out for travelers who prioritize robust medical protection, offering comprehensive pre-existing condition coverage and prescription medication benefits that prove invaluable when navigating Tokyo’s healthcare system.

Health-conscious adventurers will appreciate their specialized coverage for unique Tokyo activities, from scaling Mount Fuji’s challenging trails to exploring Japan’s renowned hot springs and winter sports destinations.

With medical coverage limits reaching $500,000 and emergency evacuation protection up to $1,000,000, IMG Global provides the premium safety net that active travelers need while experiencing everything from Tokyo’s bustling districts to Japan’s breathtaking outdoor adventures.

The company’s 24/7 travel assistance ensures immediate support for medical emergencies, passport issues, or unexpected travel complications that may arise during your Tokyo adventure.

Pre-Existing Condition Coverage and Prescription Medication Benefits

How thoroughly does IMG Global protect travelers with ongoing health conditions during their Tokyo adventures?

Their premium plans excel at covering acute onset flare-ups of pre existing conditions, providing up to $100,000 in emergency medical benefits!

Smart travelers appreciate IMG’s extensive prescription benefits, which cover emergency medications prescribed by Tokyo physicians during unexpected health episodes requiring immediate treatment.

IMG Global requires coverage to be purchased within a specific time frame after booking your trip to qualify for their comprehensive pre-existing condition benefits.

Adventure Sports Coverage for Tokyo’s Unique Activities and Excursions

What distinguishes Tokyo’s adventure scene from typical urban destinations? Mount Fuji’s proximity transforms your metropolitan getaway into mountaineering territory!

Standard policies exclude climbing injuries, skiing adventures in Nikko, and water sports around Tokyo Bay.

Smart travelers invest in adventure-specific coverage for mountaineering gear protection and explicit water sports endorsements—because freedom means exploring without limits!

Adventure travel insurance also provides emergency search and rescue coverage in remote mountainous areas where standard assistance may be unavailable.

Japanese Insurance Options and Local Provider Advantages

While international insurers certainly have their merits, savvy Tokyo travelers often discover that Japanese insurance options purchased right at Narita or Haneda airports offer surprisingly compelling advantages that can transform a potentially stressful medical situation into a seamlessly managed experience.

Major players like JTB and other established Japanese travel agencies provide exhaustive visitor insurance packages that integrate directly with Japan’s sophisticated healthcare system, eliminating the frustrating upfront payment dance that plagues many international policies.

These policies can even be purchased instantly through online platforms for travelers who have already entered Japan.

These locally-sourced insurance plans come packed with multilingual support, cashless medical transactions, and coverage limits reaching up to 10 million yen—all while being perfectly calibrated to Japan’s unique medical pricing landscape and cultural protocols.

Visitor Insurance Plans Available at Tokyo Airports Upon Arrival

Imagine this: you’ve just landed at Narita or Haneda, jet-lagged and realizing you forgot to buy travel insurance before your trip—but instead of panic, you can simply stroll over to a Tokio Marine & Nichido counter and walk away with extensive coverage in under 15 minutes!

These airport insurance kiosks offer something truly special that international providers simply can’t match: instant activation, direct hospital payment arrangements that eliminate those scary upfront medical bills, and Japanese-speaking staff who understand exactly how the local healthcare system works.

These services employ security measures similar to online platforms to protect your personal and payment information during the enrollment process.

Beyond the airports, you’ll discover that even convenience stores throughout Tokyo can sell you same-day insurance coverage, making protection as accessible as grabbing a late-night snack—talk about convenience that puts travelers first!

Convenience Store Insurance Sales and Same-Day Coverage Activation

How can travelers secure immediate insurance coverage upon landing in Tokyo when their existing policies fall short or emergencies demand instant protection?

Japanese convenience store insurance offers remarkable flexibility through 55,000+ nationwide locations!

Major chains like 7-Eleven, Family Mart, and Lawson provide same day policy activation at kiosks with multilingual interfaces, ensuring you’re protected within hours of arrival.

These stores function as a one-stop shop for travelers needing quick insurance solutions alongside other essential services.

Language Support and Local Claims Processing Benefits

Beyond the simple act of purchasing coverage, travelers discover that Japanese insurance providers offer something international policies often lack: genuine linguistic accessibility paired with streamlined local processing that eliminates bureaucratic nightmares.

Twenty-four-seven multilingual hotlines navigate cultural nuances while understanding local regulations, ensuring your medical emergency doesn’t become a translation disaster requiring expensive international claim coordination.

Major providers maintain global medical networks spanning thousands of healthcare facilities worldwide, creating seamless coordination between Japanese support staff and international medical institutions.

JTB and Japanese Travel Agency Insurance Packages

JTB’s insurance packages showcase the striking difference between bundled tour coverage and independent travel policies, with their Tokio Marine Explora Plus offering seamless integration into Japan’s complex healthcare landscape.

These Japanese travel agencies possess something invaluable that foreign insurers simply cannot replicate: deep cultural understanding of how medical emergencies unfold in Japan, plus established relationships with hospital networks that actually matter when you’re facing a crisis.

The comprehensive coverage extends beyond basic medical expenses to include personal accidents and travel inconveniences specifically tailored for Japan’s unique environment.

The contrast becomes crystal clear when comparing JTB’s culturally-attuned coverage against generic international policies that treat Tokyo like any other destination!

Bundled Tour Insurance vs Independent Travel Coverage Comparisons

When travelers book Japan adventures through major agencies like JTB, they’re often surprised to discover that bundled insurance feels more like a safety net with some serious holes than all-encompassing protection.

Travel insurance myths and coverage misconceptions run rampant!

Independent providers demolish these limitations, offering customizable medical coverage up to $2 million versus JTB’s modest ¥2,000,000 ceiling, plus superior trip cancellation benefits.

These independent options also provide 24/7 assistance hotlines for immediate support during emergencies, unlike many bundled packages that operate on limited business hours.

Cultural Understanding and Japanese Hospital Network Integration

The sophisticated dance between Japanese cultural etiquette and medical care creates a uniquely complex landscape that savvy travelers can navigate brilliantly with the right local insurance provider!

JTB’s integrated packages open seamless access to Japan’s extensive hospital network while providing essential cultural orientation.

Short-term visitors must pay out-of-pocket for medical services, which can be costly without insurance.

Their multilingual support eliminates communication barriers, transforming potentially stressful medical encounters into manageable experiences.

Budget-Friendly Insurance Strategies for Tokyo Travel

Smart Tokyo travelers know that maximizing their insurance value doesn’t require breaking the bank, especially when credit card benefits and annual policies enter the equation.

Your existing credit card might already provide solid travel protection for Tokyo trips, though these complimentary coverages often fall short of Japan’s steep medical costs and typically exclude pre-existing conditions.

Frequent visitors to Tokyo face an interesting math problem: determining whether multiple single-trip policies or one all-encompassing annual plan delivers better bang for their yen!

Budget-conscious travelers can find coverage starting at approximately $1.50 per day for basic protection during their Tokyo adventure.

Credit Card Travel Insurance Benefits and Their Tokyo Limitations

While premium cards like Chase Sapphire and Amex Platinum offer impressive travel perks that make Tokyo adventures more affordable, their coverage often crumbles when faced with Japan’s notoriously expensive healthcare system—think $10,000 trip cancellation limits that barely scratch the surface of a luxury Tokyo itinerary gone wrong.

These wallet-friendly plastic protectors typically max out at woefully inadequate amounts for serious medical emergencies, leaving travelers exposed to costs that could easily spiral into five-figure nightmares in Tokyo’s world-class but pricey hospitals.

Coverage limits are typically restricted to 90 days per trip, which can create gaps for extended stays or long-term travel arrangements in Tokyo.

The harsh reality hits hardest when you discover that your card’s $50,000 medical coverage sounds generous until you’re staring down a potential medical evacuation bill that dwarfs your entire vacation budget!

Chase Sapphire and Premium Card Coverage Gaps for Japan Travel

How confident should travelers feel relying solely on their Chase Sapphire or premium credit card benefits for an expensive Tokyo adventure?

These prestigious cards reveal significant gaps when covering Japan’s premium experiences and unique risks.

- Trip cancellation limits cap at $10,000-20,000 while luxury Japan itineraries frequently exceed these thresholds.

- Emergency evacuation coverage maxes at $100,000 versus third-party policies offering $1,000,000.

- Pre-existing medical conditions receive zero coverage regardless of stability.

- Chase card payment requirements mandate that travelers must pay for their trip costs partially with Chase cards for any coverage to apply, potentially limiting flexibility in booking arrangements.

When Built-In Coverage Falls Short of Tokyo’s Healthcare Costs

Where exactly do those premium credit card promises crumble when faced with Tokyo’s medical reality?

Cultural etiquette demands upfront payment at Japanese hospitals—no credit card guarantees accepted.

Local customs require full-cost payment from foreigners, often exceeding your card’s $20,000 limits.

That $250 excess hits hard when ambulance rides alone cost hundreds, leaving you financially exposed despite premium coverage.

While Japan offers ambulance services at no charge to users, other emergency medical costs can quickly accumulate beyond standard credit card insurance thresholds.

Annual Travel Insurance vs Single Trip Policies for Frequent Tokyo Visitors

Frequent Tokyo travelers face a pivotal financial decision when choosing between annual travel insurance policies and individual trip coverage, with the magic number being three trips per year where annual plans start making serious economic sense.

Smart budget-conscious adventurers planning multiple Japan excursions will find that annual policies averaging S$119.40 can slash costs dramatically compared to stacking three single-trip policies at S$387 total, though the coverage scope often differs markedly between these options.

The math becomes even more compelling for digital nomads and business travelers juggling Tokyo visits alongside other Asian destinations, where regional annual plans unlock seamless multi-country protection without the hassle of purchasing separate policies for each adventure.

However, travelers should note that most annual plans impose 30-day limits per individual trip, potentially requiring additional coverage for extended stays in Japan.

Cost Comparison Analysis for Multiple Japan Trips per Year

When travelers find themselves drawn back to Tokyo’s neon-lit streets and bustling markets multiple times per year, the insurance math suddenly becomes fascinating!

Smart wanderers discover that annual policies deliver substantial travel discount benefits after three trips, especially considering Japan’s visa requirements for extended stays.

- Break-even point: Annual coverage becomes cost-effective after three Tokyo adventures

- Per-trip savings: Multi-trip policies cost 20-30% less than individual plans

- Maximum duration: Most annual policies limit trips to 30-45 days each

Annual travel insurance policies typically cost around $521 annually for extended travel, making them particularly attractive for frequent Tokyo visitors who want comprehensive protection without the hassle of purchasing separate policies for each trip.

Multi-Destination Coverage That Includes Tokyo and Regional Japan Travel

Tokyo serves as the perfect launching pad for exploring Japan’s incredible diversity. Savvy travelers quickly realize that multi-destination coverage transforms their insurance investment from a necessary expense into a strategic advantage!

Extensive policies seamlessly protect your adventures from Kyoto’s temples to Hokkaido’s slopes. Annual multi-trip plans provide continuous protection for frequent visitors making multiple journeys throughout the year.

They also cover Cultural Etiquette mishaps and Local Transportation incidents across all prefectures under one smart plan.

Special Considerations for Different Types of Tokyo Travelers

Tokyo’s diverse travel landscape demands tailored insurance strategies that match each traveler’s unique circumstances and risk profile.

Families steering through crowded temples with energetic children face entirely different challenges than business executives rushing between high-stakes meetings in Shibuya.

Meanwhile, seniors exploring traditional neighborhoods require coverage that addresses age-specific health concerns, as travelers over age 65 and especially 80+ may face limited coverage options or lower maximums.

Understanding these distinct traveler categories helps guarantee your insurance policy provides precisely the protection you need for an unforgettable Tokyo adventure.

Family Travel Insurance Needs for Tokyo Vacations with Children

Families planning Tokyo adventures with children face unique insurance challenges that extend far beyond standard adult coverage, particularly when it comes to accessing pediatric medical care in a country where English-speaking children’s hospitals remain surprisingly scarce.

The magic of Tokyo Disneyland and DisneySea can quickly turn stressful if a child gets injured on Space Mountain or bumps their head at the crowded Pirates of the Caribbean attraction, making specialized theme park accident coverage absolutely essential for peace of mind.

Smart parents recognize that Japan’s upfront payment hospital system creates especially high financial stakes when little ones need emergency care, transforming extensive family travel insurance from a nice-to-have into an absolute necessity.

Pediatric Medical Care Coverage and Child-Specific Emergency Services

When children accompany parents on Japanese adventures, the standard U.S. health insurance that works perfectly at home becomes completely useless the moment they step off the plane at Narita or Haneda Airport.

Essential pediatric coverage includes:

- Emergency medical treatment – Hospital stays, doctor visits, and medication for food-related illnesses

- Child vaccination and pediatric dental emergencies during extended stays

- 24/7 assistance services with instant access to local pediatric emergency numbers

Family travel insurance policies often include children at no additional cost or reduced rates, making comprehensive Tokyo coverage more affordable for parents traveling with multiple kids.

Theme Park Accident Coverage for Tokyo Disneyland and DisneySea Visits

Beyond the standard medical emergencies that could affect any traveler, the magical worlds of Tokyo Disneyland and DisneySea present unique insurance challenges that catch many families completely off guard.

Ride safety incidents and liability waivers create coverage gaps that standard policies miss!

Theme park-specific insurance addresses guest negligence exclusions, protecting families when excitement overrides caution.

Historical incidents like the Space Mountain derailment in 2003 and subsequent ride closures demonstrate how mechanical failures can disrupt vacation plans and potentially create liability situations that require specialized coverage.

Senior Traveler Insurance Requirements for Tokyo’s Demanding Itineraries

Senior travelers exploring Tokyo’s bustling streets, towering temple stairs, and demanding walking itineraries face unique insurance challenges that require specialized coverage beyond standard travel policies.

Age-related medical conditions become particularly concerning when traversing Japan’s healthcare system, where upfront payments and language barriers can create serious obstacles for elderly visitors needing prescription refills or emergency care.

Smart seniors recognize that comprehensive insurance must address mobility assistance needs and medical equipment rental coverage, ensuring they can confidently tackle Tokyo’s physically demanding attractions without worrying about accessibility challenges or equipment failures.

Tokyo’s excellent healthcare facilities do not provide coverage for international visitors, meaning seniors face full out-of-pocket costs for any medical treatments or emergency services during their stay.

Age-Related Medical Coverage and Prescription Medication Access

The golden years shouldn’t dim the excitement of exploring Tokyo’s electric streets and ancient temples, but older travelers face unique insurance challenges that demand careful attention before boarding that trans-Pacific flight.

Age brings reduced coverage limits and travel insurance myths about medication affordability that need debunking:

- Coverage caps drop dramatically – from $2 million for younger travelers to just $10,000 for those 80+

- Pre-existing conditions face exclusions unless specifically declared with specialized policies beforehand

- Emergency prescriptions get covered while routine refills typically don’t, despite common misconceptions about blanket medication coverage

Senior travelers should also secure 24/7 emergency assistance services that provide multilingual support for navigating Japan’s healthcare system during unexpected medical situations.

Mobility Assistance and Medical Equipment Rental Coverage in Tokyo

Exploring Tokyo’s sprawling urban landscape becomes infinitely more manageable when travelers understand the city’s robust mobility assistance infrastructure and know exactly what their insurance will—and won’t—cover for equipment rentals.

Accessible transportation flourishes here—elevators grace every major station!

However, standard policies typically exclude non-emergency equipment costs.

Medical device access requires advance planning, especially during cherry blossom season.

Tokyo’s dialysis clinics provide quality care with private rooms and advanced treatments for tourists requiring specialized medical support.

Business Traveler Protection for Extended Tokyo Stays

Business travelers heading to Tokyo face unique risks that personal travel insurance simply can’t handle – from expensive laptops getting damaged in crowded Shibuya stations to vital client meetings canceled due to typhoon disruptions.

Smart corporate travelers need specialized coverage that protects both their valuable work equipment and compensates for business interruption losses, since a single delayed presentation in Tokyo’s competitive market can cost thousands in lost opportunities!

The key decision becomes whether to invest in all-encompassing corporate travel insurance or strategically supplement existing personal policies with business-specific riders that cover equipment protection up to $1,500 and daily business money losses.

Premium plans provide comprehensive protection including trip cancellation benefits up to $2,000 for those unexpected disruptions that can derail important Tokyo business meetings.

Work Equipment Coverage and Business Interruption Protection

Professional travelers heading to Tokyo with laptops, cameras, and essential work gear need robust protection that goes far beyond standard tourist coverage.

Business equipment insurance becomes your financial lifeline when expensive electronics disappear in crowded stations or hotel lobbies!

- Equipment Coverage Limits – Plans range from $1,500 basic protection to enhanced executive-level coverage.

- Trip Interruption Benefits – Reimburses non-refundable expenses for cancelled business operations.

- Filing Requirements – Police reports and ownership documentation mandatory for successful claims.

Computer items have a specific limit of $500 within the overall business equipment coverage allocation.

Corporate Travel Insurance vs Personal Policy Supplementation Options

When corporate executives face month-long Tokyo assignments versus weekend business trips, the insurance landscape shifts dramatically between employer-provided group coverage and personally-purchased policy add-ons.

Travel policy gaps emerge when personal policies cap medical evacuation at $500,000 while Tokyo hospital stays demand higher protection.

Smart travelers avoid insurance misconceptions by securing corporate plans offering unlimited emergency coverage versus limited personal alternatives.

Business travelers should verify that their coverage includes protection for outdoor activities like skiing at popular resorts across Hokkaido and Honshu during winter assignments.

Claims Process and Emergency Contact Information for Tokyo Incidents

When travel emergencies strike in Tokyo, knowing exactly how to file claims and reach the right people can transform a stressful situation into a manageable inconvenience.

Smart travelers understand that proper documentation, timely reporting, and following specific protocols make the difference between swift reimbursement and frustrating claim rejections.

The key lies in understanding Tokyo-specific procedures, recognizing which emergency services truly deliver results, and avoiding the common pitfalls that trip up even experienced international travelers.

Step-by-Step Claims Filing While Still in Tokyo

When travel mishaps strike during your Tokyo adventure, swift documentation becomes your best ally for successful claims processing.

Smart travelers snap detailed photos of damaged luggage, collect official incident reports from Narita or Haneda staff, and preserve every medical receipt from Tokyo’s pristine healthcare facilities.

Fortunately, most major insurers including Tokio Marine offer English-language customer service during Japanese business hours, transforming what could be a linguistic nightmare into a manageable administrative task.

Required Documentation and Photo Evidence for Different Claim Types

The paperwork maze surrounding travel insurance claims might seem intimidating at first glance, but savvy Tokyo travelers who understand the specific documentation requirements can navigate the process with remarkable efficiency!

- Lost luggage claims demand baggage tags plus airline documentation.

- Photo documentation captures accident scenes and property damage with timestamps.

- Medical incidents require itemized bills with certified Japanese translations.

English-Language Customer Service Access During Japanese Business Hours

Traveling Tokyo’s insurance claim process becomes remarkably straightforward once travelers discover the robust English-language support systems operating around the clock!

Tokio Marine & Nichido’s 24/7 hotline (0120-119-110) connects callers to three-way interpreter services, transforming potentially stressful situations into manageable conversations.

This thorough language support guarantees your claim process flows smoothly, even during traditional Japanese business hours when additional resources become available.

Emergency Assistance Services That Actually Help in Tokyo

When a medical crisis strikes in Tokyo, the difference between panic and peace of mind often comes down to having access to genuine emergency assistance services that actually operate in Japan’s unique healthcare landscape.

The most effective travel insurance providers offer 24/7 hotlines staffed with Japanese-speaking representatives who can navigate local medical protocols, while their extensive referral networks ensure you’ll reach quality hospitals rather than wandering helplessly through Tokyo’s complex healthcare system.

These services go far beyond basic phone support, actively coordinating hospital admissions, arranging payment guarantees, and serving as your medical advocate when language barriers could otherwise complicate life-saving treatment.

24/7 Hotline Services with Japanese-Speaking Representatives

How reassuring is it to know that when medical emergencies strike in Tokyo, several top-tier insurance providers offer dedicated hotlines staffed with Japanese-speaking representatives who can navigate the complex healthcare system on your behalf?

- EAJ’s qualified medical interpreters bridge communication gaps with call center services operating 24/7

- SafetyWing’s premium coverage includes Japanese language support starting at ¥279 daily

- Multi-provider networks serve 44+ nationalities with streamlined emergency response

Medical Referral Networks and Hospital Admission Assistance

The maze of Tokyo’s healthcare system transforms from intimidating labyrinth into navigable pathway thanks to extensive medical referral networks that connect travelers with exactly the right specialists for their specific conditions.

These hospital networks streamline everything from cardiac emergencies to trauma care!

Cashless payment systems eliminate upfront costs while professional coordinators handle medical records documentation and interpreter services seamlessly.

Common Claim Rejection Reasons and How to Avoid Them

Understanding why travel insurance claims get rejected in Tokyo can save you thousands of yen and endless frustration when you need coverage most.

Two major pitfalls consistently trip up even savvy travelers: failing to secure pre-authorization for medical treatments at Tokyo’s world-class hospitals, and getting caught off guard by activity exclusions that seem perfectly innocent until disaster strikes.

Smart travelers learn these rejection triggers before they board their flight, transforming potential claim nightmares into smooth reimbursement experiences.

Pre-Authorization Requirements for Tokyo Medical Treatments

Managing Tokyo’s medical system with travel insurance requires savvy preparation, especially when it comes to securing pre-authorization for treatments that go beyond basic emergency care.

Japan’s streamlined healthcare demands smart navigation of insurance verification and medical billing protocols before procedures begin:

- Contact your provider within 24 hours of emergency treatment to kickstart authorization.

- Gather essential documentation including physician diagnosis, treatment plans, and cost estimates.

- Leverage cashless payment systems through direct insurance billing at participating facilities.

Activity Exclusions That Catch Tokyo Tourists Off Guard

Beyond medical pre-authorizations lies a minefield of activity exclusions that regularly blindside even well-prepared Tokyo visitors, turning dream adventures into insurance nightmares.

Mount Fuji climbing outside official seasons voids coverage instantly!

Adventure sports require specific riders purchased beforehand.

Even sampling local cuisine in remote areas or attending cultural festivals can trigger unexpected exclusions without proper documentation.

Policy Comparison Tools and Shopping Strategies for Tokyo Insurance

Smart travelers know that finding the perfect Tokyo travel insurance requires more than just clicking on the first Google result – specialized comparison platforms like InsureMyTrip and American Visitor Insurance offer Japan-specific filters that reveal coverage gaps you never knew existed.

These digital tools transform the overwhelming maze of policy options into clear, side-by-side comparisons that highlight critical details like medical coverage limits exceeding Japan’s sky-high healthcare costs and emergency evacuation benefits tailored for Asia-Pacific regions.

The timing of your purchase matters just as much as your provider choice, since buying insurance within days of booking your Tokyo trip often unlocks maximum protection benefits and trip cancellation coverage that could save thousands if Mount Fuji decides to throw a volcanic tantrum!

Online Comparison Platforms That Include Japan-Specific Coverage Details

Smart travelers know that SquareMouth and InsureMyTrip stand out as powerhouse comparison platforms, offering robust filtering systems that let you zero in on Tokyo-specific coverage requirements like high medical expense limits and typhoon protection.

These user-friendly sites make it simple to sort through dozens of policies simultaneously, but here’s the critical part—you absolutely must read the fine print for Japan-specific exclusions that could leave you vulnerable during emergencies.

The devil’s in the details when it comes to coverage limitations for activities like skiing in nearby mountain resorts or restrictions on pre-existing medical conditions that might affect your Tokyo adventure.

SquareMouth and InsureMyTrip: Filtering for Tokyo Travel Needs

Navigating Tokyo travel insurance becomes remarkably straightforward when travelers harness the filtering power of SquareMouth and InsureMyTrip, two leading comparison platforms that transform the overwhelming maze of policy options into clear, side-by-side choices.

- Premium tiers range from basic $100,000 medical coverage to extensive $500,000 protection, with coverage exclusions clearly displayed for each Tokyo-bound adventure.

- Adventure activity filters identify policies covering Mount Fuji hikes and skiing excursions.

- Natural disaster protection addresses typhoon-related disruptions during Tokyo travel seasons.

Reading Policy Fine Print for Japan-Specific Exclusions and Limitations

The devil lurks in those densely packed paragraphs of policy fine print, where Japan-specific exclusions hide like secret ingredients in a complex ramen recipe.

Savvy Tokyo travelers know that skipping this crucial reading step could leave them financially stranded when Mount Fuji’s slopes or Shibuya’s neon-lit streets present unexpected challenges.

Policy exclusions targeting earthquakes, winter sports, and traditional medicine treatments require careful scrutiny before purchasing coverage.

Timing Your Insurance Purchase for Maximum Tokyo Trip Protection

The timing of your Tokyo travel insurance purchase can make the difference between extensive protection and costly coverage gaps, especially when considering the unique risks of Japanese travel like typhoon season disruptions and earthquake-related delays.

Smart travelers who secure their policies within 10-15 days of booking gain access to powerful benefits like Cancel for Any Reason upgrades—which must be purchased within 21 days of your initial trip payment—while last-minute buyers often find themselves locked out of these premium protections.

Whether you’re planning cherry blossom viewing in spring or powder skiing in Hokkaido, understanding the strategic advantages of early purchase versus the limited options available for procrastinators will help you maximize your coverage while minimizing your premium costs.

Early Purchase Benefits vs Last-Minute Coverage Options

While spontaneous adventures hold undeniable appeal, purchasing Tokyo travel insurance follows a dramatically different rulebook where timing transforms from mere convenience into cold, hard cash savings and superior protection.

Premium discounts and strategic purchase timing create compelling advantages:

- Early birds save 10-15% compared to last-minute buyers

- Full pre-existing condition coverage requires 14-21 day advance purchase

- Maximum benefits activate only with proper timing windows

Cancel for Any Reason Upgrades Worth Considering for Tokyo Travel

How much financial protection does a traveler really need when venturing to Tokyo’s neon-lit streets and ancient temples?

Cancel for Any Reason upgrades offer freedom from rigid airline policies and unexpected local customs disruptions.

Trawick International’s CFAR reimburses 50-75% of costs, but purchase within 10-21 days of your deposit—timing matters for maximum Tokyo adventure protection!

Wrapping Up

Like a carefully packed umbrella tucked into your backpack, travel insurance serves as your invisible shield against Tokyo’s unexpected storms.

Whether you’re steering through bustling Shibuya crossings or savoring ramen in hidden alleys, extensive coverage transforms potential disasters into manageable bumps.

Smart travelers understand that protecting their Tokyo adventure isn’t just about money—it’s about preserving those precious memories you’ll treasure forever.

Your dream trip deserves that security blanket!